7 Easy Facts About Pkf Advisory Services Shown

7 Easy Facts About Pkf Advisory Services Shown

Blog Article

Little Known Facts About Pkf Advisory Services.

Table of ContentsThe Only Guide to Pkf Advisory ServicesThe 5-Minute Rule for Pkf Advisory ServicesThe Ultimate Guide To Pkf Advisory ServicesPkf Advisory Services Things To Know Before You Get ThisA Biased View of Pkf Advisory Services

If you're seeking additional information past what you can locate on-line, it's easy to get started with an in-depth, individualized financial strategy that you can assess without cost or commitment. And we make it very easy to place your plan into activity. Simply register in our handled portfolio service with an affordable ordinary net advisory cost of 0.5% (minimum account equilibrium of $250,000). Delight in the ongoing support of a dedicated advisor in your corner.The overall price you are expected to pay, consisting of the web advisory cost and the underlying fund charges and expenses, is about 1.00% of assets under administration. For added details on fees and costs of the service, please review the Fees and Payment section of the. The T. Rowe Cost Retirement Advisory Service is a nondiscretionary financial preparation and retired life revenue planning service and a discretionary handled account program given by T.

Brokerage accounts for the Retired life Advisory Solution are given by T. Rowe Cost Investment Solutions, Inc., participant FINRA/SIPC, and are carried by Pershing LLC, a BNY Mellon firm, participant NYSE/FINRA/SIPC, which works as a clearing up broker for T. Rowe Rate Investment Services, Inc. T. Rowe Cost Advisory Services, Inc. and T.

Our Pkf Advisory Services PDFs

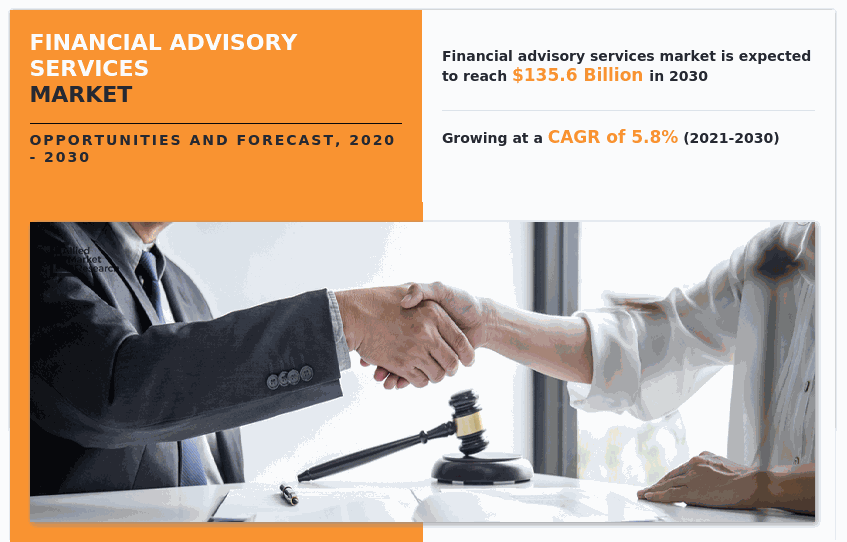

Providing suggestions is an important component of IFC's method to create markets and mobilize personal investment. With this job, we help develop the needed conditions that will attract one of the most exclusive capital, allowing the economic sector to grow. IFC is moving to an extra strategic approach, methodically linking our consultatory programs to the greatest demands identified in World Financial institution Group nation and sector strategies.

Financial guidance can be helpful at transforming points in your life. Like when you're beginning a family, being retrenched, planning for retired life or managing an inheritance.

The Definitive Guide for Pkf Advisory Services

Once you've agreed to go ahead, your monetary advisor will prepare a financial strategy for you. You need to always feel comfortable with your consultant and their advice. PKF Advisory Services.

Prior to you purchase an MDA, contrast the advantages to the expenses and risks. To secure your cash: Don't offer your adviser power of lawyer. Never sign an empty file. Put a time frame on any authority you provide to deal financial investments on your part. Firmly insist all correspondence about your financial investments are sent out to you, not simply your consultant.

This may happen throughout the conference or electronically. When you get in or restore the continuous cost plan with your advisor, they ought to explain just how to end your relationship with them. If you're transferring to Recommended Site a new adviser, you'll require to organize to transfer your financial documents to them. If you require help, ask your advisor to explain the process.

The Single Strategy To Use For Pkf Advisory Services

Several properties come with responsibilities connected. It comes to be essential to figure out the actual value of a possession. The expertise of clearing up or canceling the responsibilities includes the understanding of your financial resources. The overall procedure assists construct properties that do not end up being a burden in the future. It made use of to be called saving for a wet day.

Why? Like your go-to car person, financial consultants have years of training and experience behind them. They have a deep understanding of monetary items, market movement, and take the chance of browse around this site monitoring so you can trust that the decisions that compose your economic plan are made with self-confidence. How will you know these decisions are made with your benefit in mind? If your monetary advisor is a fiduciary, then they are lawfully bound to act in your finest passion not their very own.

Pkf Advisory Services - An Overview

This is what you can make use of to attempt the sushi location down the road or see your preferred band at Red Rocks. PKF Advisory Services. When it concerns tax obligations, an excellent monetary expert will certainly make sure that you're only paying the minimum quantity you're called for to pay, helping you put a few of your hard-earned cash back in your pocket

The prospective value of monetary recommendations depends on your economic circumstance. You need aid establishing economic objectives for your future You're not certain how to invest your money You're in the center of (or preparing for) a significant life event You need liability or an impartial 2nd point of view You simply do not such as dealing with cash To identify if functioning with a monetary advisor imp source is right for you and make certain a successful connection, the best point to do is ask good concerns up front.

If it does not feel right, it's alright to explore other choices. Here are a few examples of concerns you can ask an economic expert in the very first meeting. A monetary advisor that is a fiduciary is needed by legislation to act in your best rate of interest. This suggests that they can only advise financial strategies that benefit you, whatever phase of your economic trip you're in.

Report this page